One of the main reasons for the decrease in applications is due to a change in what is required to secure the loan, which can also serve as a grant, said John Brown, president of Park National Bank in Springfield.

Businesses and nonprofit organizations have to show that they have seen a 25% drop in revenue when compared to the same period in 2019. That requirement was not the case when the program first rolled out in April of 2020.

Brown said the latest extension for when companies can apply for the PPP loan is to give extra time before money allocated to that program runs out.

Additional stimulus money that will be released this year will mainly go to other programs designed to help small businesses.

When the first round of PPP funding rolled out around April of last year, it was uncertain what long term impact the pandemic and shutdowns caused by it would have on area businesses and nonprofits, Brown said.

Due to the changes implemented for businesses currently applying for a PPP loan, fewer businesses are able to show a 25% or more drop in revenue, Brown said.

As a result, Park National has seen about 40% of the activity centered around PPP loans this year when compared to the same time in 2020, Brown said.

The original deadline for businesses and nonprofits to apply for those loans this year was in March but that has since been extended.

The money comes from the CARES Act passed in March of 2020 to help provide relief amid the coronavirus pandemic. Money from the American Rescue Plan Act of 2021, a $1.9 trillion stimulus package passed this year, will be allocated in a number of different ways to help small businesses.

Credit: Bill Lackey

Credit: Bill Lackey

That includes new funds and tax credits to help struggling small businesses.

The new bill includes targeted aid for restaurants in the form of grants, additional aid, and an expansion of existing credits such as the Employee Retention Tax Credit, according to the Greater Springfield Partnership.

In terms of the PPP loan extension, the idea is to make sure that remaining funds will be directed to small businesses and nonprofit organizations that were the hardest hit by the pandemic.

The PPP loan is designed to be forgiven for small businesses that are able to retain their workforce by the end of the loan period. It is also set up to encourage those businesses to bring back employees who were temporarily laid off as a result of the pandemic.

Small businesses who apply can receive a maximum loan of two and a half times more than their average monthly payroll reported in 2019.

Small businesses and non-profits with fewer than 20 employees and sole proprietors can apply for second draw PPP loans through May 31.

While the majority is to be used for payroll expenses, businesses can use a portion of it to cover costs such as rent or mortgage payments during the loan period, this news organization previously reported.

Some businesses that applied for loans through the program last year have done better than expected amid the pandemic, Brown said. Others have been able to pick up business as restrictions ease in the state.

The program in total has offered more than $687 billion in pandemic relief.

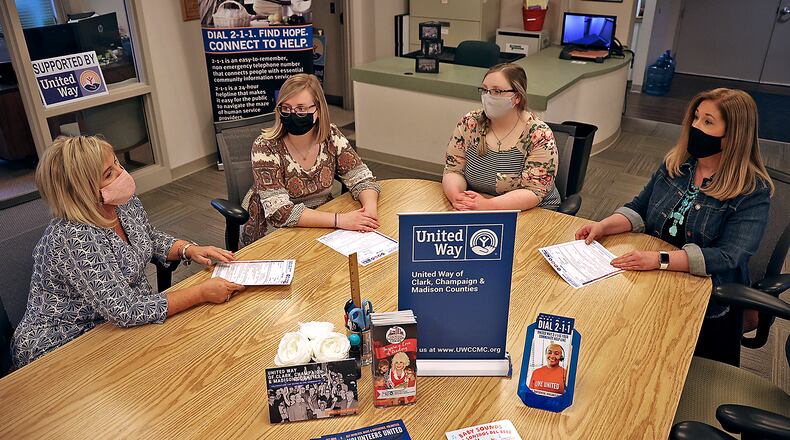

For some organizations, like the local United Way, it has offered a lifeline as they navigate a dip in funding and a higher demand in community programming.

The United Way -which serves Clark, Champaign and Madison counties- has applied for the loan twice, including recently, seeking $49,680 both times to cover employee expenses as well as overhead costs, according to its executive director Kerry Pedraza.

The organization that serves the county has four employees and allocates funding to 25 programs in Clark County that tackle a range of issues such as food insecurity and homelessness.

“A lot of our partner agencies fulfill basic needs. Some have been able to secure additional donations. But the need for those services have also increased.” Pedraza said.

The United Way secures most of its funding through its annual campaigns.

However, due to the economic impact of the pandemic, money raised during those campaigns have decreased between 2019 and 2020. That number dropped from $1,378,452 to $1,205,246.

Though the 2020 campaign has not ended yet, Pedraza anticipates collections will still be less than what was collected 2019.

“We are anticipating that we will see additional pledge loss resulting from unanticipated retirements, layoffs, work furloughs, etc at workplaces,” she said.

However, PPP loans have helped the nonprofit as it experiences a dip in donations.

Pedraza said money from the loans covers administration costs allowing for more money raised to go to its partner programs. Traditionally 85 to 87 cents per dollar raised goes to community programs.

About the Author